In 2024, India continues to be a fertile ground for entrepreneurship, with a rapidly growing economy and a burgeoning startup ecosystem. However, succeeding in this environment requires more than just a great idea. Aspiring entrepreneurs must embrace an entrepreneurial mindset, understanding the fundamentals of business while being prepared to navigate challenges with resilience and innovation.

Starting your own business in India involves a systematic approach, where each step builds upon the last. If you’ve decided to embark on this exciting journey, this guide will provide you with a detailed roadmap to help you turn your entrepreneurial dreams into reality.

Step 1: Research and Refine Your Idea

The foundation of any successful business is a strong idea. However, it’s not enough to simply have a good idea; you need to thoroughly research and validate it. Begin by determining whether your idea solves a real problem or fulfills a need in the market. This step involves a deep dive into market research, competitor analysis, and understanding your target audience.

- Market Research: Start by identifying the problem your product or service solves. Then, explore how others are currently addressing this issue. Use surveys, interviews, and focus groups to gather data on potential customers’ needs and preferences. This information will help you refine your idea and ensure that there is a market for your product or service.

- Competitor Analysis: Study your competitors to understand their strengths and weaknesses. Analyze their products, pricing strategies, marketing techniques, and customer service. This will not only help you differentiate your offering but also give you insights into what works and what doesn’t in your chosen industry.

- SWOT Analysis: Conduct a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis of your idea. This will help you identify the internal and external factors that could impact your business. Understanding these factors early on will enable you to refine your idea, making it more resilient and adaptable to market changes.

Step 2: Write a Detailed Business Plan

A well-structured business plan is essential for turning your idea into a viable business. It serves as a roadmap, guiding you through the startup phase and helping you stay focused on your goals. Moreover, a detailed business plan is crucial when seeking funding or partnerships, as it provides potential investors with a clear picture of your business model, market strategy, and financial projections.

Your business plan should include the following key components:

- Executive Summary: This is a snapshot of your business idea, including your mission statement, vision, and goals. It should be concise yet compelling, as it’s often the first section investors read.

- Company Description: Provide detailed information about your business, including its structure, location, and the problem it solves. Explain how your product or service stands out in the market.

- Market Analysis: Offer an in-depth analysis of your industry, target market, and competitors. Use data to support your claims and demonstrate a clear understanding of market trends and consumer behavior.

- Organization and Management: Describe your business’s legal structure and provide details about the ownership and management team. Highlight the experience and skills of your team members, as this can be a significant factor for investors.

- Product or Service Line: Explain what your product or service is, how it benefits customers, and its lifecycle. Include any plans for future product development or expansion.

- Marketing and Sales Strategy: Detail how you plan to attract and retain customers. Discuss your pricing model, sales tactics, and promotional strategies.

- Funding Request: If you’re seeking funding, specify how much you need and how you plan to use it. Outline your funding needs over the next five years and align them with your financial projections.

- Financial Projections: Provide detailed financial forecasts, including income statements, cash flow projections, and balance sheets. These should align with your funding requests and demonstrate the potential profitability of your business.

- Appendix: Include any additional documents that support your business plan, such as resumes, legal documents, permits, and other relevant materials.

Step 3: Secure Funding

Funding is a critical aspect of starting and scaling a business. In India, the funding landscape has evolved significantly, offering entrepreneurs various avenues to raise capital. However, it’s important to understand that securing funding requires careful planning and strategy.

- Seed Funding: This is the initial capital you need to get your business off the ground. It can come from personal savings, loans, or investments from friends and family. Alternatively, you can approach angel investors who specialize in early-stage investments.

- Venture Capital: If your business has the potential for rapid growth, venture capitalists (VCs) can provide substantial funding in exchange for equity. In India, several VC firms focus on tech startups, healthcare, and fintech.

- Government Schemes: The Indian government offers various schemes and incentives to support startups, such as the Startup India initiative, which provides funding, tax benefits, and mentoring. Explore these options to see if your business qualifies for any grants or subsidies.

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow you to raise small amounts of money from a large number of people. This can be a good option if your product has mass appeal.

- Bank Loans: Traditional bank loans are another option, but they usually require collateral and a solid business plan. The Indian government also offers Mudra loans specifically designed for small and medium enterprises (SMEs).

Step 4: Decide on the Legal Structure

Choosing the right legal structure for your business is crucial as it affects everything from how you file taxes to your personal liability. In India, there are several legal structures you can choose from:

- Sole Proprietorship: Ideal for small, one-person businesses, this structure is easy to set up and gives the owner complete control. However, the owner is personally liable for all debts and obligations.

- Partnership: If you’re starting a business with one or more partners, this structure allows you to share profits and responsibilities. Partnerships can be general, where all partners share liability, or limited, where some partners have limited liability.

- Limited Liability Partnership (LLP): This structure combines the benefits of a partnership with the limited liability of a corporation. It’s suitable for businesses that want to limit the personal liability of their partners.

- Private Limited Company: A popular structure for startups, a private limited company is a separate legal entity from its owners, offering limited liability protection. It also makes it easier to raise capital from investors.

- Public Limited Company: Suitable for larger businesses, this structure allows you to raise capital from the public through the issuance of shares. It requires more regulatory compliance and transparency than a private limited company.

- One Person Company (OPC): Introduced in the Companies Act, 2013, OPC allows a single individual to own and manage a company. It offers limited liability protection and is ideal for solo entrepreneurs who want the benefits of a corporate structure.

Step 5: Plan Your Finances and Taxes

Financial planning is one of the most critical aspects of starting a business. Before you launch, you need to ensure that your business is financially viable and that you have a plan to manage cash flow, expenses, and taxes.

- Budgeting: Create a detailed budget that outlines your startup costs, ongoing expenses, and revenue projections. This will help you manage your finances and ensure that you have enough capital to sustain your business until it becomes profitable.

- Bank Accounts: Open a separate business bank account to keep your personal and business finances separate. This will make it easier to manage your cash flow and prepare for tax season.

- Accounting System: Invest in good accounting software to track your income, expenses, and profits. A reliable accounting system will help you manage your finances, prepare financial statements, and file taxes.

- Tax Planning: Understand the tax obligations for your business, including income tax, GST (Goods and Services Tax), and TDS (Tax Deducted at Source). Hire a tax consultant or accountant to ensure compliance with all tax laws and regulations.

- Financial Projections: Regularly update your financial projections to reflect changes in the market, your business model, or your financial situation. This will help you stay on track and make informed decisions about your business.

Step 6: Register Your Business

Registering your business is a crucial step in establishing your company as a legal entity. The process involves several steps, including choosing a name, obtaining the necessary licenses, and registering with various government bodies.

- Business Name Registration: Choose a unique name that reflects your brand and business type. Check if the name is available and not already trademarked. Once confirmed, register the name with the Registrar of Companies (ROC).

- Domain Registration: If your business will have an online presence, register a domain name that matches your business name. This will be important for your website, email addresses, and online branding.

- Obtain Necessary Licenses: Depending on your business type, you may need various licenses and permits to operate legally. These could include a trade license, GST registration, and industry-specific permits.

- Director Identification Number (DIN) and Digital Signature Certificate (DSC): If you’re setting up a company, you’ll need to obtain a DIN for the directors and a DSC for filing online documents.

- Incorporation: File the necessary incorporation documents with the ROC. This includes the Memorandum of Association (MOA) and Articles of Association (AOA), which outline the structure and rules of your company.

Step 7: Secure Licenses and Permits

In addition to registering your business, you need to obtain the necessary licenses and permits to operate legally. The specific requirements will vary depending on your industry and location.

- Trade License: Obtain a trade license from your local municipal authority. This license is necessary for businesses that operate within a particular jurisdiction.

- GST Registration: If your business’s turnover exceeds the threshold limit, you’ll need to register for GST. This allows you to collect and remit taxes on the goods and services you provide.

- Industry-Specific Licenses: Depending on your business, you may need additional licenses. For example, if you’re in the food industry, you’ll need an FSSAI license. Similarly, businesses in the pharmaceutical, chemical, or construction industries may require specific permits.

- Trademark and Patent Protection: If your business involves unique branding, products, or technology, consider registering for a trademark or patent. This will protect your intellectual property and prevent others from using your brand or inventions without permission.

Step 8: Execution and Setting Up Operations

With all legal and financial groundwork laid, it’s time to execute your business plan. This involves setting up your business location, hiring a team, and establishing your operational processes.

- Business Location: Whether it’s a physical office, a retail store, or a home office, choose a location that suits your business needs. Consider factors such as accessibility, cost, and proximity to suppliers and customers.

- Hiring: Building the right team is critical to your business’s success. Hire employees, consultants, or freelancers with the skills and experience needed to help your business grow. Focus on creating a strong company culture that aligns with your vision and values.

- Operations: Set up the necessary operational processes, including supply chain management, inventory control, customer service, and quality assurance. Invest in technology and tools that can help streamline your operations and improve efficiency.

- Training and Development: Invest in training programs for your employees to ensure they have the skills and knowledge needed to perform their roles effectively. This will also help you build a strong, capable team that can contribute to your business’s growth.

Step 9: Develop Leadership Qualities

As an entrepreneur, leadership skills are crucial for managing your team, building relationships with stakeholders, and navigating challenges. Effective leadership involves clear communication, decision-making, and the ability to inspire and motivate others.

- Communication: Develop strong communication skills to articulate your vision and goals clearly to your team, investors, and customers. Good communication is key to building trust and ensuring everyone is aligned with your business objectives.

- Decision-Making: As a leader, you’ll need to make tough decisions, often with limited information. Develop the ability to analyze situations quickly, weigh the pros and cons, and make informed choices that benefit your business.

- Motivation: Inspire and motivate your team by setting a positive example and recognizing their contributions. Foster a collaborative work environment where everyone feels valued and empowered to contribute to the business’s success.

- Adaptability: The business landscape is constantly changing, and successful leaders are those who can adapt quickly to new challenges and opportunities. Stay flexible and open to new ideas, and encourage your team to do the same.

Step 10: Promote Your Business

Once your business is up and running, the next step is to attract customers and build your brand. Marketing and promotion are crucial for driving sales and growing your business.

- Digital Marketing: Leverage digital marketing channels such as social media, search engine optimization (SEO), and email marketing to reach a wider audience. Platforms like Facebook, Instagram, LinkedIn, and Google Ads offer targeted advertising options that can help you connect with potential customers.

- Content Marketing: Create valuable content that educates and engages your target audience. This could include blog posts, videos, infographics, and podcasts. Content marketing helps build brand awareness, establish authority, and drive traffic to your website.

- Networking: Attend industry events, trade shows, and networking meetups to build relationships with other entrepreneurs, potential clients, and investors. Networking can lead to new business opportunities and valuable partnerships.

- Public Relations: Use PR strategies to generate media coverage for your business. A well-crafted press release can help you gain visibility in newspapers, magazines, and online publications.

- Influencer Marketing: Collaborate with influencers in your industry who can promote your products or services to their followers. Influencer marketing can be a powerful tool for reaching new audiences and building credibility.

- Customer Engagement: Build relationships with your customers by engaging with them on social media, responding to their feedback, and offering exceptional customer service. Happy customers are more likely to become repeat buyers and refer your business to others.

Final Takeaway

Starting a business in India in 2024 requires careful planning, research, and execution. By following the steps outlined in this guide, you can increase your chances of success and build a sustainable business. Remember that entrepreneurship is a journey that requires persistence, resilience, and continuous learning. Stay focused on your goals, adapt to changing market conditions, and never stop innovating.

Success in business doesn’t happen overnight; it’s the result of consistent effort, strategic planning, and a commitment to excellence. With the right approach, you can turn your entrepreneurial dreams into a thriving reality.

Author Profile

- Nitin Jain - C.E.O - India PR Distribution

- Nitin Jain is the founder and C.E.O of India PR Distribution - India's top Press Release Distribution and PR Agency. Nitin has more than 20 years of experience in PR, Corporate Communications, Digital Marketing, Branding Strategy and Lead generation.

Latest entries

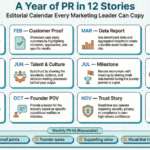

Press releaseJanuary 31, 2026A Year of PR in 12 Stories: The Editorial Calendar Every Marketing Leader Can Copy

Press releaseJanuary 31, 2026A Year of PR in 12 Stories: The Editorial Calendar Every Marketing Leader Can Copy EntrepreneursJanuary 5, 2026Nitin Jain Entrepreneur Behind India PR Distribution Success

EntrepreneursJanuary 5, 2026Nitin Jain Entrepreneur Behind India PR Distribution Success Press releaseNovember 20, 2025Meet Nitin Jain: CEO of India PR Distribution

Press releaseNovember 20, 2025Meet Nitin Jain: CEO of India PR Distribution Search OptimizationSeptember 16, 2025What Is Digital PR and Why It Matters for SEO Success

Search OptimizationSeptember 16, 2025What Is Digital PR and Why It Matters for SEO Success